Costing with SAP S/4HANA's Material Ledger

This content was originally published on the SAP PRESS Blog.

SAP PRESS is the world's leading SAP publisher, with books on ABAP, SAP S/4HANA, SAP CX, intelligent technologies, SAP Business Technology Platform, and more!

Material ledger accounting refers to the ability to generate financial transactions at a material level, providing granular detail of inventory movement.

Although many call the location of this material level detail in SAP the Material Ledger, it is actually stored as part of the Universal Journal in SAP S/4HANA Finance.

Actual costing is an optional feature that can be activated as part of the Material Ledger to revalue materials at their actual cost as part of period-end close. It is important to understand that actual costing is an element of the Material Ledger, but requires additional transaction processing to calculate and revalue inventory based on actual costs.

SAP Material Ledger

One of the major changes in SAP S/4HANA in regard to management accounting (inventory valuation, to be specific) is that the Material Ledger is now obligatory in SAP S/4HANA.

In other words, the Material Ledger and finance in SAP S/4HANA provide inventory valuation, rather than Material Ledger and materials management, as was the case with prior versions. Material valuation is now stored in Material Ledger tables rather than materials management tables.

This change enables dynamic Material Ledger reporting, which is a powerful capability, given the technical advancements of SAP HANA data. Additionally, the Material Ledger supports ad-hoc reporting capabilities with SAP Fiori, as well as with other analytics tools. Now, inventory valuation is brought into the Universal Journal, serving as a single source of truth.

Actual Costing

Implications of Material Ledger in SAP S/4HANA

The fact that Material Ledger is now obligatory in SAP S/4HANA does not mean an additional effort on your part in terms of implementation, period-end close, or reporting. Rather, this activation of Material Ledger in SAP S/4HANA enables inventory valuation reporting as part of the Universal Journal. Advanced reporting capabilities are just one of the benefits.

The new solution enables inventory values to be stored in multiple currencies and, if you choose to activate multiple valuation views, according to several parallel accounting standards. Technical benefits include the elimination of redundant data, since local currency inventory value is stored in both material master and Material Ledger tables.

Additionally, this offers improved scalability through optimization of the locking mechanism when material documents are created.

There are two new Material Ledger document tables in SAP S/4HANA: MLDOC and MLDOCCCS. These tables replace the following periodic tables: MLHD, MLIT, MLPP, MLPPF, MLCR, MLCRF, MLKEPH, CKMLPP, CKMLCR, MLCD, CKMLMV003, CKMLMV004, CKMLPPWIP, and CKMLKEPH.

Transfer Pricing and Multiple Valuation Approaches

Transfer prices allow organizations to value goods and services exchanged between different organizational units within the corporation. By valuing the exchange of goods and services using transfer prices, you can significantly influence the actual success of your corporate divisions or profit centers.

For example, when company code A sells raw materials to company code B, company B pays company A a transfer price. This transfer price may be based on company code A’s cost plus a markup, or based on a market price. The transfer price provides company code A with a profit that aligns with legal reporting requirements and is represented in financial reporting.

At a corporate level, the intercompany profit on company code A and intercompany cost on company code B are eliminated to represent a consolidated corporate financial report. The transfer pricing and multiple valuation approach functionality in SAP S/4HANA enables reporting on both of these views.

As in financial accounting, parallel valuation can be implemented in controlling to attribute valuation approaches to a particular ledger in the general ledger. You can manage up to three valuation approaches, or valuation views, in parallel to support transfer pricing: legal valuation view, group valuation view, and profit center valuation view.

The following valuation views are available:

- The legal valuation view provides a view of company codes as separate legal entities with transfer pricing between companies within the corporation. Aligned with the accounting principles of the leading ledger within the general ledger.

- The group valuation view provides a view of the organization as a group reporting entity rather than many legal entities (company codes). This view can be used to provide a reporting view without intercompany transfer pricing for decision making at a corporate (group) level.

- The profit center valuation view enables reporting on profit centers when profit centers represent divisions within an organization and drive transfer pricing with different profits and profit margins.

Activating Valuation Views

Often legal and group valuation are required for reporting, but profit center valuation is not. In this case, it is recommended to only activate the valuation views that are required or will be required in the future. Activating profit center valuation requires maintenance of additional configuration to map transfer prices at a profit center level. If not required, this additional configuration creates unnecessary additional system processing time and ongoing maintenance.

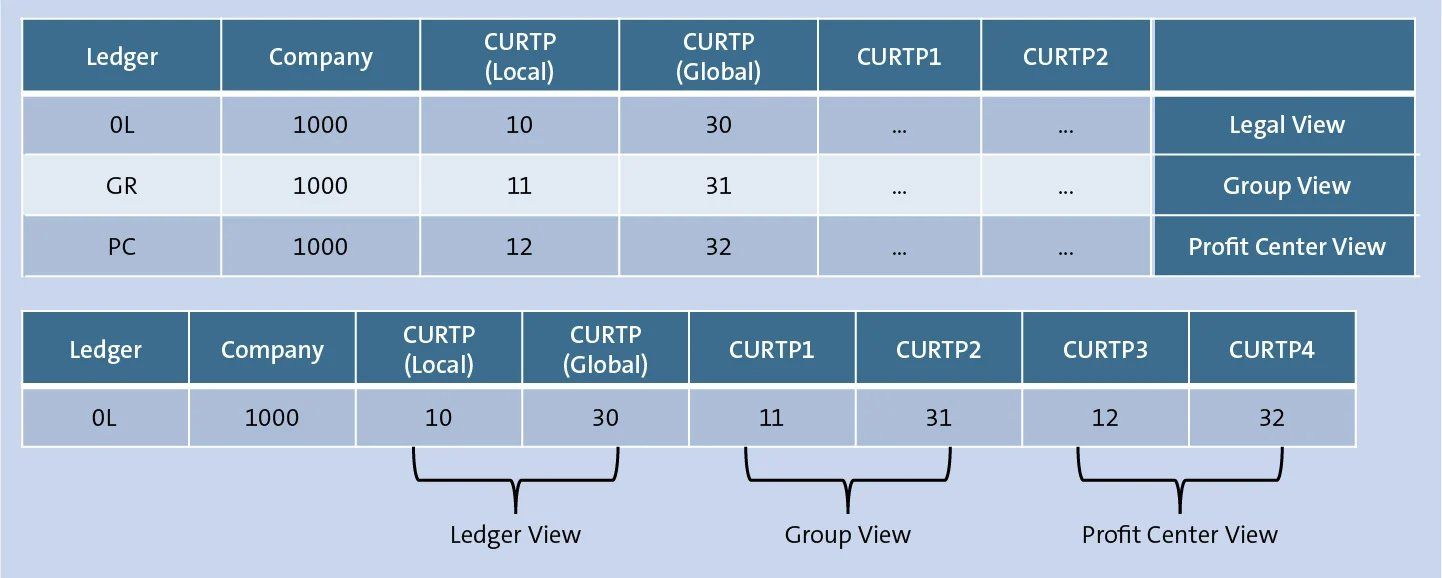

For your valuation views, you can either use separate ledgers, or map multiple valuation views within a ledger as follows:

- Parallel single-valuation refers to the assignment of valuation approaches each to a single ledger (i.e., legal valuation assigned to leading ledger). Parallel single-valuation includes: Valuation assigned to ledger, option for new implementations, simpler authorization concept, separate close processing required by valuation view.

- Multi-valuation ledger refers to the assignment of one ledger to all currency types and valuation views. The multi-valuation ledger includes: currency types of all valuation views can be used in that ledger, no separate close required by valuation view, optimized memory, valuation view specified in reporting.

You can select per each ledger whether you want to enable a parallel single-valuation or multi-valuation approach. The leading ledger can be used either with the legal valuation view or without restriction to one valuation view. However, it cannot be configured exclusively with only group or profit center valuation views.

Multiple Valuation Views

If you want to use multiple valuation views within a ledger, do not assign a valuation view to that ledger. This enables all currency types to be available for reporting within that ledger. The following depicts how you can design your ledgers to coincide with valuation views.

Parallel Valuation Functionality in SAP S/4HANA 1809

Parallel valuation is enhanced in SAP S/4HANA 1809 to allow multiple currencies in journal entries, allocations (assessments and distributions), and asset capitalization and depreciation.

Actual Costing Runs

The actual costing cockpit provides a way to perform the various steps included in actual costing runs. These steps include production and process order closure, overhead cost calculation, allocations, actual cost split, actual activity rate calculation, and actual costing itself.

Changes within the actual costing run functionality in SAP S/4HANA include the following:

- A change of standard price for materials and activities within the period is now supported

- If a material is reprocessed by settlement, the system now automatically recognizes the dependent materials on higher costing levels need to be reprocessed

- Consumption price differences are now considered

- A new two-dimensional distribution logic avoids rounding errors

- Price limiter logic is accurate on the cost component split level

Similar to costing run execution, the actual costing cockpit requires that you create a costing run and enter parameters for execution. Prior to SAP S/4HANA, you would perform the following eight steps to process the actual costing run:

- Selection

- Determine sequence

- Single-level price determination

- Multi-level price determination

- Revaluation of consumption

- WIP revaluation

- Post closing

- Mark material prices

The processing steps previously performed in Transaction CKMLCP (single level price determination, multilevel price determination, revaluation of consumption, and WIP revaluation) are replaced in SAP S/4HANA by a single settlement step. The settlement step performs cost allocations and actual price calculations. The sequence of reduced steps in the Material Ledger Actual Costing Cockpit app are as follows:

- Selection

- Determine sequence

- Settlement

- Post closing

- Mark material prices

- Other Changes to Actual Costing

There are several other changes to the Material Ledger’s actual costing cockpit (Transactions CKMLCP and CKMLCPAVR):

- A new parameter Application makes it possible to process alternative valuation runs via Transaction CKMLCP, and actual costing runs via Transaction CKMLCPAVR.

- In the toolbar of Transactions CKMLCP and CKMLCPAVR, there is a new button next to Display <-> Change to switch the application from Costing Run to Run Reference and vice versa.

- It is no longer possible to use delta posting runs in the actual costing cockpit.

Conclusion

This blog on the SAP Material Ledger/actual costing provided an overview of the key changes in SAP S/4HANA Finance to the Material Ledger, actual costing, and transfer pricing. Several new SAP Fiori apps were described which provide enhanced capabilities including actual costing runs and actual costing cockpit.

Editor’s note: This post has been adapted from a section of the book SAP S/4HANA Finance: An Introduction by Maunil Mehta, Usman Aijaz, Tanya Duncan, and Sam Parikh.